They will make the change if it involves a modification to SFHAs, and therefore has significant consequences for property owners and insurance rates. FEMA generally does not revise a map that is currently effective. This process will start a formal determination of your property’s location and elevation relative to a SFHA. If you believe that there has been a mistake in your flood zone designation, you have the option to submit a Letter of Map Change (LOMC) Request to FEMA. Given this, FEMA depends on communities to report changes to flood hazard information and submit technical information on any changes. Therefore, FEMA prioritizes areas of study where there is new development or areas where the maps are most outdated. Due to constraints in funding, FEMA can only study a limited number of communities each year. in order to create and revise flood hazard maps. How do you Change your FEMA Flood Zone?Įach year, FEMA studies and updates flood zone information in communities across the U.S.

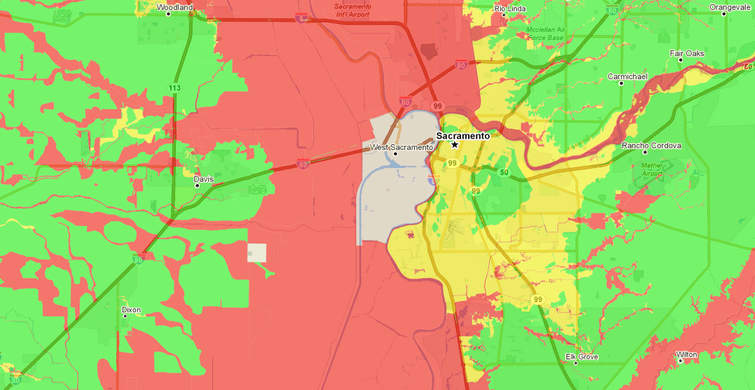

The several different types of petitions are collectively called “Letters of Map Change” (LOMC). Paying for insurance can be expensive, but thankfully property owners and renters have the option to petition FEMA to remove your home from a high-risk flood zone designation. The flood zone designation of your house or property is important because flood zones are the basis for floodplain management regulations in your community and whether you are required to purchase flood insurance or not. If you are in a high-risk flood zone (A, AO, AE, AR, A99, AH, VE, V) you are in a Special Flood Hazard Area (SFHA) with a 1% or more risk of flooding per year on average, sometimes also referred to as the base flood or one-percent-annual-chance-flood. Referencing FIRMs is the best way to see the relationship between your property and areas with the greatest risk of flooding. First, Check Your Your Flood Insurance Rate Mapįlood Insurance Rate Maps (FIRMs) produced by FEMA are used to determine the probability of flooding in a specific flood zone. Property owners can save a significant amount of money on flood insurance by making sure their flood zone accurately reflects the risk of flooding. Changing your flood zone is possible through a FEMA Letters of Map Change (LMOC) form, but only in instances where your property was misidentified or there have been changes in the property’s location or elevation. Both of these can merit a request to change your flood map. FEMA recognizes that hydrology science sometimes makes mistakes, and also that steps can be taken to mitigate flood risk on a property.

0 kommentar(er)

0 kommentar(er)